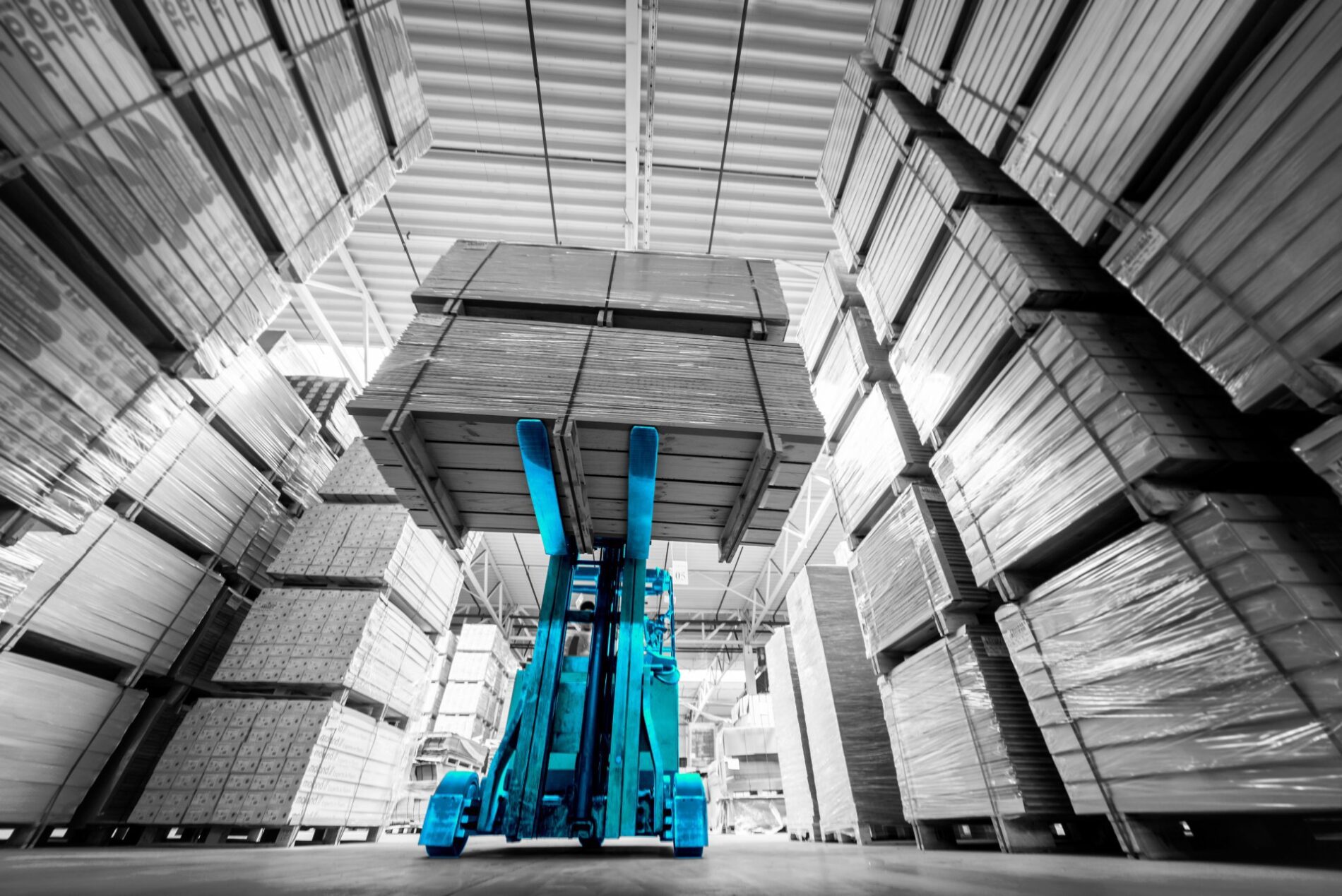

The focus of our investment strategy is on plots over 20,000 SQM on proven logistics locations with multimodal accessibility throughout the Benelux, Germany and Spain. Both greenfield and brownfield plots receive our fullest attention. Here, we develop big box warehouses over 10,000 SQM as well as future-oriented last mile facilities, either on a built-to-suit or speculative basis.

By being in control of all processes, i.e., development, leasing and asset management, we offer the capacity to structure our deals in an optimal way, providing balanced, risk adjusted returns for our investors.

For investments in highly specialised areas, we form joint venture arrangements with both specialist partners, co-developers and other third parties. We fully intent on keeping our investments in our portfolio for the long run, therefore we are strongly committed to high quality, sustainability and adaptability. By these arrangements, we are able to serve our clients optimal real estate investment management.

|

INVESTMENT PROFILE |

|

|

Asset Type |

|

|

Type of Use |

|

|

Locations |

|

|

Target Countries |

|

|

Investment Volume |

|

|

Net Initial Yield |

|

|

Required Information |

|